- Home

- Sustainability

- Governance

- Corporate Governance

Governance

- Policy and Basic Concept

- Structures and Systems

- Election of Directors

- Evaluation of CEO and CEO Succession Plan

- Matters concerning compensation for Directors and Audit and Supervisory Board Members, etc.

- Assessing effectiveness of Board of Directors

- Training for Directors and Audit and Supervisory Board Members

- Cross-Shareholding

Corporate Governance

Policy and Basic Concept

The Ricoh Group is working to enhance its governance system in accordance with social awareness and various stakeholders aimed at strengthening competitiveness and continuously improving the system while ensuring transparency based on corporate ethics and legal compliance. In this way, the Ricoh Group will achieve continuous growth, and improve corporate value and shareholder value.

The Ricoh Group established The Ricoh Way as a set of guiding principles and values that serve as the foundation for all our business activities. The Ricoh Way, which comprises our founding principles, Mission & Vision, and Values, is the foundation of our management policy and strategy, and also is the basis of its autonomous corporate governance.

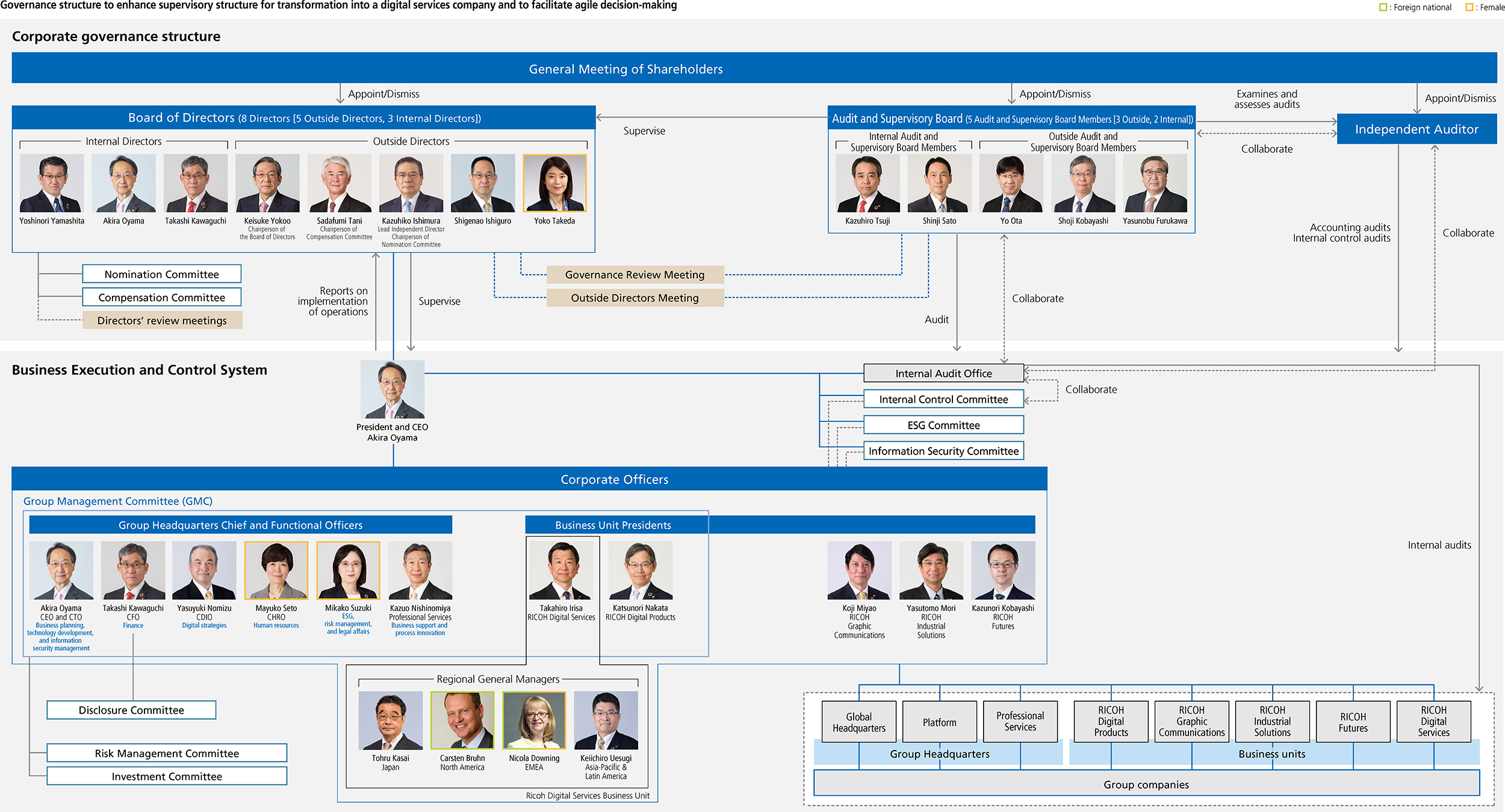

The Company has introduced a corporate audit system. In addition, the Company is making efforts to enhance oversight of executive management by the Board of Directors and enhance execution of operations by the executive officer system. Furthermore, by appointing Outside Directors, the Company is making efforts toward further improvement of corporate governance by decision-making and oversight of executive management through discussion from their independent perspectives.

The nomination and compensation of Directors and Executive Officers are deliberated by the Nomination Committee and the Compensation Committee, advisory bodies that are comprised of a majority of Independent Outside Directors. The recommendations of each committee are reported to the Board of Directors.

As of November 15, 2023

Structures and Systems

Board of Directors

The Board of Directors is responsible for management oversight and essential decision-making for Group management. By appointing highly independent Outside Directors, the Group ensures greater transparency in its management and fair decision-making.

We have established a system in which non-executive directors, including independent outside directors, and directors in charge of execution, utilize their expertise and experience to engage in in-depth discussions on important issues. This encourages new challenges that lead to growth while simultaneously supervising management from the perspective of shareholders and other stakeholders. As a rule, all directors must attend at least 80% of Board of Directors meetings. They must also supervise corporate management effectively. In fiscal 2021, five of the 10 members of that body were outside directors. This was in keeping with an ongoing effort to incorporate diverse views and opinions and to eliminate arbitrary decision-making in management.

Ricoh decided to increase the ratio of outside Board of Directors members from at least one-third, to a majority, effective from fiscal 2022. It also appointed a lead outside director, so outside directors could better perform their roles and functions. The lead outside director is responsible for enhancing governance in collaboration with the Board chairperson. Lead outside director appointments will be made as needed based on Board judgments, in view of operational situations and chairperson and director appointments. The chairperson and lead outside director will ensure suitable collaboration and role allocations to help the Board function smoothly and fulfill its roles.

- Maximum number of Directors: 8

- Current number of Directors: 10 (including 5 Outside Directors)

- Term: 1 year

As of June 23, 2023

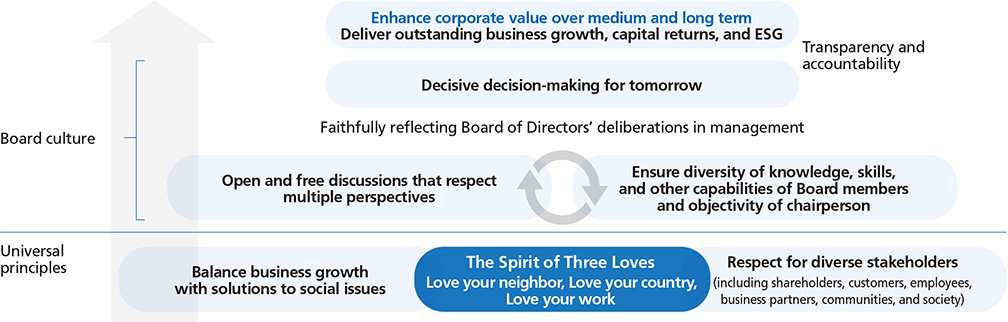

Board Culture

The Board of Directors reflected on Ricoh's founding spirit to discuss the ideas and stances that underpin that body's deliberations, decisions, and actions to help enhance corporate value. It accordingly defined the following Board culture.

The Board of Directors shall:

- Honor the Spirit of Three Loves, engaging with and respecting the interests of shareholders, customers, employees, partner companies, communities and society, and other stakeholders while overseeing management strategies and plans that help resolve social issues.

- The chairperson shall objectively lead diverse and highly independent Board members in engaging and constructive deliberations that value a diversity of open and free viewpoints. Management shall faithfully reflect the results of deliberations.

- Board members shall understand their social responsibilities, make robust decisions for the future, and oversee management's implementation of decisions, so Ricoh can enhance medium- and long-term corporate value by delivering exceptional business growth, capital profitability, and ESG performances.

With the business climate and management structure changing, the Board will constantly refer back to the culture described above in deliberating, making decisions, choosing directors, and engaging with shareholders and other stakeholders.

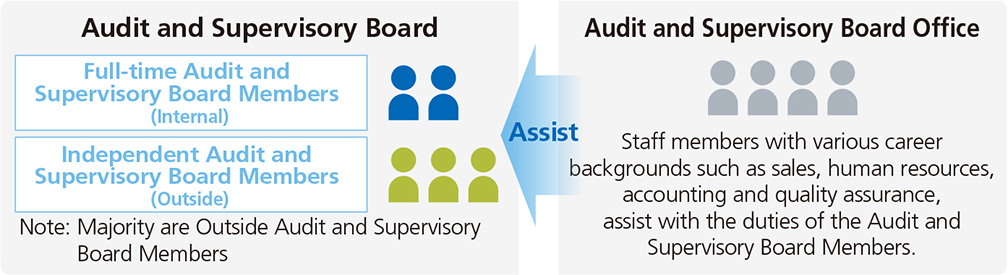

Audit and Supervisory Board

The Audit & Supervisory Board discusses and decides on audit policies and assignment of duties, audits the execution of duties by Directors, plays a supervisory function on management through cooperating with the Company's Independent Auditor and the internal audit division, and auditing internal departments and subsidiaries. Audit & Supervisory Board Members attend important meetings, including but not limited to the Board of Directors meetings, and exchange information regularly with Representative Directors.

The Company has five Audit & Supervisory Board Members, comprising two (2) full-time members who are familiar with internal circumstances and three outside members who meet the requirements for independent Audit & Supervisory Board Member set by the Company, and the majority of the members are independent Outside Audit & Supervisory Board Members. In addition, the Audit & Supervisory Board is required to secure necessary knowledge, experience, and specialized abilities in a well-balanced manner in forming the Audit & Supervisory Board. We have built a system that enables deep discussions from an independent and objective perspective, capitalizing on a wealth of experience and wide-ranging insight in the specialized fields of each Audit & Supervisory Board Member.

- Maximum number of Audit and Supervisory Board Members: 5

- Current number of Audit and Supervisory Board Members: 5 (including 3 Outside Audit and Supervisory Board Members)

- Term: 4 years

As of May 19,2023

Coordination of the audit function

In order to ensure effective performance of duties by Audit & Supervisory Board Members, in addition to the activities reported in the Notes on the Audit Performance, the Audit & Supervisory Board coordinates as appropriate with Audit & Supervisory Board Members, the Independent Auditor and Internal Audit Office to strengthen and enhance all aspects of the Company's audit function.

1. Three-way audit coordination

Audit & Supervisory Board Members, the Independent Auditor and the Internal Audit Office (the Company's internal audit division), meet to discuss audit policies, plans and methods. In addition, basic information and risk information related to subsidiaries, which had previously been managed in various places across the Group, has been gathered into one place and reorganized into “integrated risk information database for the Ricoh Group,” which can be shared and utilized effectively by each audit body. The Audit & Supervisory Board also holds quarterly three-way audit meetings with the Independent Auditor and the Internal Audit Office, to exchange information on the details and results of audits, and exchange opinions regarding matters such as the status of internal control and risk assessment, with the aim of ensuring a shared awareness of issues.

2. Individual coordination

- Coordination between Audit & Supervisory Board Members and the Internal Audit Office

Full-time Audit & Supervisory Board Members hold regular monthly meetings with the Internal Audit Office and the corporate officer in charge of internal controls, to discuss the results of audits and ensure a shared awareness of issues. In addition, the Internal Audit Office reports quarterly to the Audit & Supervisory Board on the status of its activities, and engages in an exchange of opinions that includes the perspectives of Independent Outside Audit & Supervisory Board Members.

- Coordination between Audit & Supervisory Board Members and the Internal Audit Office

Full-time Audit & Supervisory Board Members hold regular monthly meetings with the Internal Audit Office and the corporate officer in charge of internal controls, to discuss the results of audits and ensure a shared awareness of issues. In addition, the Internal Audit Office reports quarterly to the Audit & Supervisory Board on the status of its activities, and engages in an exchange of opinions that includes the perspectives of Independent Outside Audit & Supervisory Board Members.

- Coordination between the Independent Auditor and the Internal Audit Office

The Internal Audit Office shares the results of internal audits with the Independent Auditor and engages in the exchange of opinions.

Training for Directors and Audit & Supervisory Board Members

Training for the Company's Directors and Audit & Supervisory Board Members has the objective of enabling constructive discussion that contributes to improving shareholder value and corporate value through the oversight functions of the Board of Directors. It is conducted by acquiring and updating knowledge specific to the duties and environment for each of the Company's Internal and Outside Directors and Audit & Supervisory Board Members. The goal of the training is to enable them to fulfill their roles and responsibilities appropriate for an executive who holds a position in the Company's important governing bodies.

Upon appointment of Internal Directors and Audit & Supervisory Board Members, training is provided to allow these persons to confirm their expected roles and duties, as well as acquire knowledge necessary to carry out their duties, including knowledge regarding corporate governance, law, and finance. Even after appointment, training opportunities are provided via internal/external training and e-learning initiatives suited to each Director and Audit & Supervisory Board Member so they can update their knowledge.

Outside Directors and Audit & Supervisory Board Members are appointed from among those who have adequate insight and experience necessary to carry out duties. Upon appointment, to enable them to deepen their understanding of the Company's current status, they are briefed on topics such as business strategy, financial conditions, and organizational structure as well as make site visits to key locations as required. In addition, even after appointment, efforts are made to ensure and improve the management oversight function of the Board of Directors and the effectiveness of audits by Audit & Supervisory Board Members, through the regular provision and sharing of information on the status of the Company, the management environment, risks in business operations, etc., as well as the provision of an opportunity to grasp the actual situation of the company, such as participation as an observer in the management meeting (Group Management Committee) and site inspections.

To confirm that the above measures are being conducted appropriately, their results are reported to the Board of Directors.

Committees

Nomination Committee/Compensation Committee

As part of strengthening the management oversight functions by the Board of Directors, the Nomination Committee, which a Non-executive Director chairs, and the Compensation Committee, which is chaired by an Outside Director, with the majority of members on both committees being Non-executive Directors and at least half of the members being Outside Directors, were established. The establishment of these committees is to ensure transparency and objectivity of selection, dismissal, and compensation of Directors and Executive Officers, etc. In addition, one Outside Audit and Supervisory Board Member attends the deliberations of the Nomination Committee and Compensation Committee as an observer each time.

Governance and Directors' Review and Outside Executive Meetings

Governance review meetings provide a forum for comprehensive discussions on the Ricoh Group's direction of governance and related issues by Directors, Audit and Supervisory Board Members, and other relevant parties. The outlines of the review meetings held are disclosed in the Corporate Governance Report and other documents.

Directors' review meetings provide an opportunity and time for Directors and Audit and Supervisory Board members to thoroughly discuss important corporate themes (such as the mid-term management plan ) in advance of the Board of Directors resolution.

Outside Executive Meetings are forums to contribute to the deliberations of the Board of Directors by sharing information and views between outside directors and members of the Audit and Supervisory Board based on independent and objective perspectives.

Group Management Committee

The Board of Directors authorizes the president and CEO to chair this decision-making body, which comprises executive officers with certain qualifications.

Disclosure Committee

This committee is composed of representatives from different functional organizations, including the disclosure management division, accounting division, legal division, business planning division, Board of Directors operating division, public relations division, and internal control division, information-generating and acknowledging departments, the Supervising Organizations managing affiliates, and the CFO, who is responsible for information disclosure.

Internal Control Committee

The Internal Control Committee is an organization to deliberate and make decisions on the internal control system of the whole Ricoh Group.

This committee is composed of GMC members and is chaired by the CEO. Delegated by the CEO, the committee determines the policies for internal control activities of the entire Ricoh Group in accordance with internal control principles, and periodically evaluates and rectifies the internal control development and operation status. In consideration of environmental changes, the committee makes proposals to the Board of Directors to revise the internal control principles as necessary.

Risk Management Committee

It is an advisory body to the GMC that was established to strengthen risk management processes across the entire Ricoh Group. The committee is chaired by the corporate officer in charge of risk management and has experts from each organization as members to ensure comprehensive coverage of risks and substantial discussions, and to propose to the GMC specific risks requiring response or focus in terms of the management of the Ricoh Group. Furthermore, the committee will review and restructure the risk management system as necessary, in order to strengthen the effectiveness of risk management across the Ricoh Group.

In addition, in order to establish a more effective and integrated risk management system through coordination between management and each business execution organization, we have appointed risk management managers and promoters from each organization, and established an autonomous risk management system for each organization.

Moreover, at the Group Risk Management Collaboration Reinforcement Conference for each risk management promoter, study sessions and information sharing related to risk management are held, and ongoing efforts are making the organization more responsive to risk.

Investment Committee

This advisory body to the GMC scrutinizes investment plans in financial perspective terms in view of capital costs and in terms of profitability and growth risks from business strategy perspectives. The committee aims to accelerate and improve investment decision-making for diverse external investment and funding projects through members representing different functional organizations engage in preliminary assessments and discussions to be more consistent with management strategies and improve investment effectiveness.

ESG Committee

The ESG Committee aims to respond promptly and appropriately to the expectations and requests of stakeholders by continuously discussing environmental, social, and governance issues faced by the Ricoh Group. Chaired by the president and CEO and comprising* internal directors, GMC members, and business unit presidents, this decision- making body meets every quarter.

- *

- Outside auditors participate as observers

Election of Directors

Approach to Election of Directors

Election Criteria for Directors

Superior insight and judgment necessary for management functions

- Knowledge of a wide range of businesses and functions, and the ability to think and make decisions appropriately from a company-wide and long-term perspective

- Insight into the essence of issues

- Vision to make best decisions on a global leve

- Judgment and insight based on extensive experience, as well as excellent track record leading to significant improvements in corporate value and competitive strength

- Ability to think and make decisions appropriately from the perspective of various stakeholders including shareholders and customers based on a firm awareness of corporate governance

Positive trust relationships between Directors and management team for smooth performance of the oversight function

- Integrity (honesty, moral values and ethics); exemplifies fair and honest decisions and actions based on a high sense of morality and ethics in addition to the strict observance of laws, regulations, and internal rules.

- Ability to interact with others with deference and trust based on a spirit of respect for humanity and set an example for decisions and actions that respect the personality and individuality of others based on a deep understanding and acceptance of diverse values and ideas.

Election criteria for Outside Directors

In addition to the same election criteria as for Internal Directors stated above, the election criteria for Outside Directors include expertise in different fields, problem discovery and solving capabilities, insight, strategic thinking capabilities, risk management capabilities, and leadership qualities.

Diversity Policy

We believe that the Company's Board of Directors should be composed of directors with management ability and a rich sense of humanity, in addition to diverse viewpoints and backgrounds, in addition to sophisticated multilateral skills. When considering diversity, our policy is to select candidates based on their character and insight without distinction of race, ethnicity, gender, nationality, etc. In addition, we also ensure diversity of expertise and experience in various management-related fields.

Election Process and Evaluation Process for Directors

We are making ongoing efforts to strengthen and enhance corporate governance for our sustainable growth and improvement of corporate and shareholder value.

Nomination Committee

The Board established the Nomination Committee, which ensures that procedures for appointing, dismissing, and evaluating Directors, the CEO, and other management team members are objective, transparent, and timely. In order to enhance objectivity and independence, the committee is chaired by a Non-executive Director, and the majority of the members are Non-executive Directors, with at least half being outside directors. During fiscal 2021, the committee was chaired by an Outside Director with four Outside Directors, one internal Non-executive Director, one Internal Executive Director, and a majority of Outside Directors.

The Nomination Committee deliberates on the following inquiries and reports on the deliberation and conclusions to the Board of Directors.

- Nomination of candidates for CEO and Directors

- Evaluation of the soundness of the CEO and Directors to continue in their duties

- Evaluation of achievements of the CEO and Directors

- Confirmation of status of CEO succession plans and development of future CEO candidates

- Confirmation of appointment/dismissal proposals and reasons thereof for Corporate Vice Presidents, Group Executive Officers, Advisors, and Fellows

- Approval or disapproval on the formulation, revision or abolishment of appointment/dismissal systems for Directors, Corporate Vice Presidents, and Group Executive Officers

- Other matters individually consulted by the Board of Directors

- Confirmation of reasons for selecting candidates for Audit & Supervisory Board Member based on requests from the Audit & Supervisory Board

- Confirmation of performance evaluation of Executive Officers

- Other matters consulted by the CEO

Election process

In order to maintain a Board of Directors structure that enables appropriate and effective management decision-making and supervision of business execution, the Nomination Committee undertakes ongoing deliberation on the composition of the Board and the specializations, experience (skills and career matrix), etc. required of Directors. Candidate nominations for Director are deliberated by the Nomination Committee over two sessions and undergo a strict screening process. Based on the reporting from the Nomination Committee, the Board of Directors deliberates from shareholder perspectives. It determines the candidates to be submitted to the General Meeting of Shareholders.

Evaluation process

Directors are evaluated annually by the Nomination Committee. From the year ended March 31, 2019, the former one-step evaluation was modified to a two-step evaluation. In the first evaluation, careful and appropriate deliberations are made on the soundness of Directors to continue in their duties, ensuring timeliness of appointment and dismissal. In the second evaluation, Directors' achievements are evaluated with a multifaceted approach, and their issues are clarified through feedback in an effort to improve the quality of management.

Furthermore, evaluations are based on such standards as “Management oversight status as a Director,” “Financial aspects including key management indicators regarding business results, return on capital, etc.;” and “Contribution to shareholders and evaluation by capital markets.”

| Evaluation Perspectives | Categories | Key Evaluation Items | Item Details and Supplementary Information |

|---|---|---|---|

| Management oversight | Qualities and abilities | Actions to maximize corporate and shareholder value, stances on executive oversight and mutual checks and balances among directors, risk management, and vital insights for corporate management | |

| Financial indicators | Results | Consolidated results | Sales, operating profit, profit attributable to owners of the parent, return on equity, return on invested capital, and free cash flow |

| Progress with fiscal 2021 business plans | Key measures by business unit and region | ||

| Performance under 20th Mid-Term Management Plan | Finance and key measures | ||

| Capital market and shareholder indicators | Capital markets | Share price indicators | Share price, market capitalization, and price-to-book ratio |

| Ratings | |||

| Shareholders | Total shareholder returns |

In evaluating directors, we use total shareholder returns, a criterion for contributing to shareholders and capital market evaluation perspectives. We base the calculation on the average share price for the fiscal year to avert the impact of sudden share price fluctuations.

Evaluation of CEO and CEO Succession Plan

Evaluation of CEO and CEO Succession Plan

The CEO succession plan is an important initiative for improving shareholder value and corporate value of the Ricoh Group in a continuous manner over the medium to long-term and continuously fulfilling the social responsibilities of the Group as a member of the society.

From the viewpoint of strengthening corporate governance, the Group works to establish a CEO succession plan with procedures that are objective, timely, and transparent.

CEO Evaluation

The CEO is evaluated annually in two steps by the Nomination Committee, at the request of the Board of Directors. In the first evaluation, careful and appropriate deliberations are made on the soundness of the CEO to continue in his/her duties, ensuring timeliness of appointment and dismissal. In the second evaluation, the CEO's achievements are evaluated with a multifaceted approach, and his/her issues are clarified through feedback in an effort to improve the quality of management. The Nomination Committee's deliberations and conclusions on the evaluation of the CEO are reported to the Board of Directors to effectively oversee the CEO.

As with Executive Directors, the CEO is evaluated based on the “Management oversight status as a Director,” “Financial aspects including key management indicators regarding business results, return on capital, etc.” and “Contribution to shareholders and evaluation by capital markets” (see above), as well as “Future financial viewpoint” to evaluate his/her overall management supervision and business execution capabilities as a CEO.

| Evaluation Perspectives | Category | Evaluation Items (typical items) | Item Details and Supplementary Notes |

|---|---|---|---|

| Management oversight status | Same categories and evaluation items as for Directors | ||

| Financial indicators | Same as above | ||

| Capital market / shareholder indicators | Same as above | ||

| Future financial indicators | ESG | Environment | Environmental management initiatives |

| Society | SDGs initiatives | ||

| Governance | System, disclosure, IR, compliance | ||

| Employees | Development and use of human resources | Personnel systems and work environment | |

| Employee engagement | External survey | ||

| Safety and health | Workplace safety and health management | ||

| Customers | Serious incident | Product and information security | |

| Customer satisfaction | External survey | ||

Selection, development and evaluation of CEO candidates

Once a year, the CEO prepares a list of potential future CEO candidates together with a development plan for them and elaborates on the proposals at the Nomination Committee. The Nomination Committee deliberates on the validity of the CEO candidate list and development plans, provides advice to the CEO on candidate development, and reports the findings to the Board of Directors. The Board of Directors confirms the validity of the candidate selection and development plans upon reporting from the Nomination Committee and is actively involved in the selection and development of CEO candidates.

CEO candidates are selected by terms in the table on the left according to the timing of the change. The backup candidate in case of accident in the table on the left is determined via resolution of the Board of Directors at the same time the CEO is selected.

| Terms | Number of persons selected |

|---|---|

| Backup candidate in case of accident | One |

| First candidate in line | Several |

| Second candidate in line | Several |

The Nomination Committee deliberates on the development plan for future CEO candidates and gives guidance to the CEO, who provides growth opportunities suited to each candidate according to their individual targets, allowing the candidates to accumulate experience. The CEO also gives direct guidance to promote the candidate's development based on individual assessment.

CEO candidates receive annual evaluations. The CEO reports on the achievements and growth of each candidate during the development period (April to March next year) to the Nomination Committee in early November (the evaluation period is from April to October, which is the month before the Nomination Committee meets). The Nomination Committee deliberates whether to maintain or replace individuals on the CEO candidate list. Where necessary, it assesses candidates, tapping advice from outside experts and other sources, reports on its findings to the Board of Directors. Upon reporting from the Nomination Committee, the Board of Directors evaluates the CEO candidates. It confirms the validity of deliberations on which candidates are to remain and is actively involved in the process.

Matters concerning compensation for Directors and Audit and Supervisory Board Members, etc.

Compensation policy

Executive compensation is positioned as an effective incentive to achieve sustainable increases in corporate earnings for the medium to long term in the pursuit of increased shareholder value of the Ricoh Group. In addition, from the viewpoint of strengthening corporate governance, measures to secure objectivity, transparency, and validity are taken in setting up compensation levels and determining individual compensation. Ricoh determines executive compensation based on the following basic policies:

| Compensation composition |

|

|---|---|

| Governance |

|

Policy regarding decisions on individual compensation, etc., and matters related to performancelinked compensation, non-monetary compensation, etc. for fiscal 2021

Process for determining compensation

The Company has established a voluntary Compensation Committee to build a more objective and transparent compensation review process that helps increase profits, enhance corporate value, and strengthen corporate governance through incentives. The Compensation Committee determines each compensation plan for basic compensation, bonuses, compensation for acquiring stock, and stock-based compensation with stock price conditions after multiple deliberations based on the compensation standards for Directors and business performance, as well as the results of the Nomination Committee's evaluation of Directors, and makes recommendations to the Board of Directors. The Board of Directors deliberates and decides on each compensation plan recommended by the Compensation Committee. With respect to bonuses, the Board of Directors determines the total amount of bonuses to be paid after confirming that the amount of bonuses for each individual Director is appropriate in accordance with the formula for Directors' bonuses, and decides on a proposal for the payment of bonuses to Directors and whether or not to submit the proposal to the General Meeting of Shareholders. After the proposal for payment of bonuses to Directors is approved at the General Meeting of Shareholders, the amount of the individual bonuses determined by the Board of Directors is paid.

Policy for determining compensation level

From the perspective of ensuring appropriate linkage with corporate performance, the Compensation Committee confirms every fiscal year whether the target level of the Company's performance is secured for each compensation category. Basic compensation refers to the compensation level of officers of the benchmark company group* based on survey results of external specialized agencies. Short-term and medium- to longterm incentives are set to the level that is at a higher level among the benchmark company group if our operating profit level is higher than the performance of the benchmark company group, and at a lower level among the benchmark company group if our operating profit level is lower.

- *

- Approximately 20 companies are selected from among competitors in the office automation field, electrical equipment manufacturers, and global companies of similar size (in terms of net sales, number of employees, etc.).

| Type | Name | Internal Director | Outside Director | Comments | |

|---|---|---|---|---|---|

| Executive | Non executive | ||||

| Fixed | Basic compensation | ○ | ○ | ○ | Compensation based on roles and responsibilities |

| Variable (short-term) | Performance-linked bonuses | ○ | ○ | ― | Linked to achievement of performance targets |

| Variable (long-term) | Compensation for acquiring stock | ○ | ― | ― | The entire amount paid is used for the acquisition of Ricoh shares through the Executive Stock Ownership Plan |

| Stock-based compensation with stock price conditions | ○ | ― | ― | Incentive to enhance corporate and shareholder value over the medium to long term | |

Basic compensation is monetary compensation paid monthly during the term of office as a compensation that reflects the roles and responsibilities expected of Directors. The amount of compensation is decided within the range of the total amount of compensation determined at the general meeting of shareholders, and the total amount of compensation paid for FY2021 was 296.15 million yen.

| Composition of compensation | Main method of setting compensation levels | |

|---|---|---|

| Internal Directors | “ Compensation pertaining to management oversight” and “compensation reflecting the importance of individual roles and management responsibilities” as a base, with additional “compensation based on positions for the Representative Director, Chairperson of the Board of Directors, etc.” |

|

| Outside Directors | “Compensation pertaining to management oversight” and “compensation pertaining to advice to management” as a base, with additional “compensation based on positions, such as Chairperson of the Nomination Committee and Chairperson of the Compensation Committee” |

|

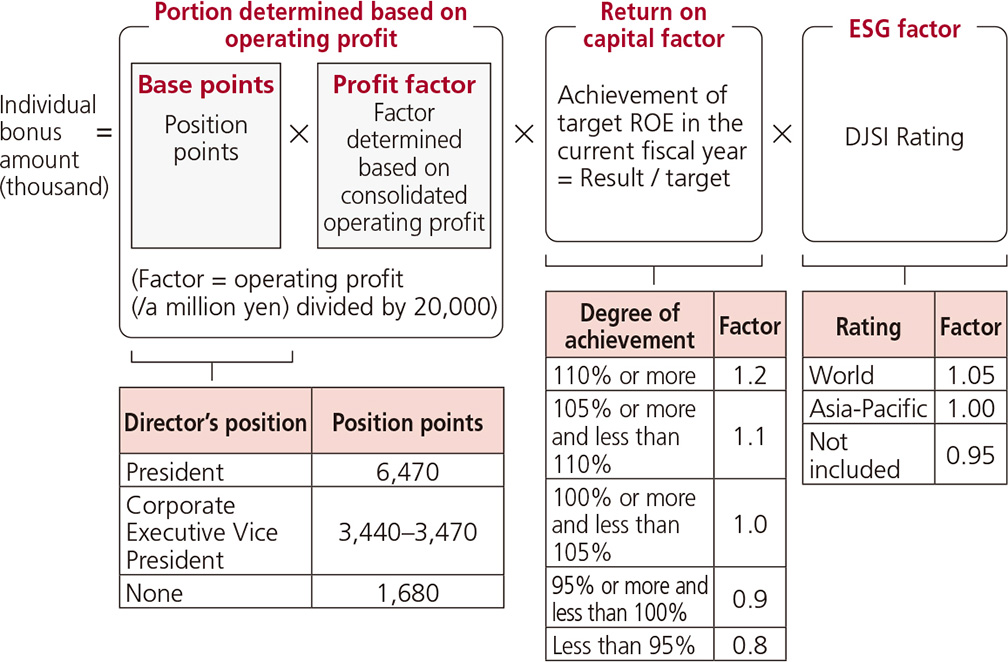

Performance-based bonuses are monetary compensation paid after the end of a fiscal year as compensation that reflects the Company's performance and shareholder value improvements in the target fiscal year. For FY2021, the following indicators were established.

| Evaluation indicator | Reason (objective) |

|---|---|

| Consolidated operating profit | Clarify that Directors are responsible for increasing earnings and improving profitability by setting operating profit, which correlates with market capitalization and represents achievements in business activities, as an evaluation indicator |

| Achievement of target ROE in the current fiscal year | Clarify that Directors are responsible for improving shareholder value by setting ROE, a key indicator for enhancing return on capital, as an evaluation indicator |

| Annual DJSI* Rating | Provide an incentive for ESG improvement by using the DJSI's annual rating, which is used as a tool for confirming company-wide ESG initiatives, as an evaluation indicator |

In addition, the Compensation Committee deliberates on the appropriateness of individual bonus payment amounts based on the results calculated by the formula below, including the results of the evaluation of Directors by the Nomination Committee, and make recommendations to the Board of Directors, which then decides whether or not to submit a proposal for the payment of bonuses to Directors to the General Meeting of Shareholders. With regard to bonuses for fiscal 2021, the Compensation Committee's deliberations determined that the results calculated according to the formula below are appropriate, and the total amount to be paid is 29.69 million yen.

- *

- Dow Jones Sustainability World Index (DJSI): A share index jointly developed by Dow Jones in the US and S&P Global, a company specializing in research on sustainable investment, the Dow Jones Sustainability Index measures the sustainability of major companies around the world from the three perspectives of economy, environment and society.

Compensation that reflects the stock price consists of the following “compensation for acquiring stock,” and “stock-based compensation with stock price conditions” for the purpose of further strengthening Directors' commitment to improving the Company's corporate value over the medium- to long-term.

(Compensation for acquiring stock)

Compensation for acquiring stock is monetary compensation intended to steadily increase the number of shares held by the Directors and to share with shareholders the benefits and risks arising from fluctuations in the stock price. Compensation for acquiring stock is paid monthly as fixed salary during the term of office, and the entire amount paid is used for the acquisition of stock by the Ricoh Executive Stock Ownerships Plan. The amount is set for each position within the range of the total compensation decided at the general meeting of shareholders, and the total compensation paid for FY2021 was 11.73 million yen.

(Stock-based compensation with stock price conditions)

Stock-based compensation with stock price conditions aims to raise awareness of contributions to improving medium- to long-term corporate value and shareholder value by clarifying the link between Directors' compensation and the value of the Company's stock, and by making Directors share benefits and risks of fluctuations in stock prices with shareholders. The stock-based compensation with stock price conditions is a system under which the Board Incentive Plan trust (hereinafter referred to as the “Trust”) established by the Company with monetary contributions acquires the Company's shares from the stock exchange market and delivers the number of Company shares equivalent to the number of points granted by the Company to each Director through the Trust (hereinafter referred to as the “System”).

In principle, a Director receives delivery of the shares of the Company at retirement. The number of points granted to each Director by the Company corresponds to the position of each Director in accordance with the Share Grant Regulations determined by the resolution of the Board of Directors. As the system is intended for the Directors to share benefits and risks of stock price fluctuations with shareholders, the final number of shares to be delivered will in principle be determined by multiplying the points granted by a rate (0 to 200%) obtained from the results of comparison of the growth rate of the Company's stock price during the term of office with the growth rate of TOPIX. In addition, pre-issuance malus-clawback clause has been established to request the return of stock-based compensation in the event of serious misconduct that causes damage to the Company during the Director's term of office. The amount recorded as expenses based on the points granted for the stock-based compensation with stock price conditions in FY2021 is 14.74 million yen. As no Directors retired in fiscal 2021, there is no disclosure item regarding the actual growth rate of the Company's stock price.

Assessing effectiveness of Board of Directors

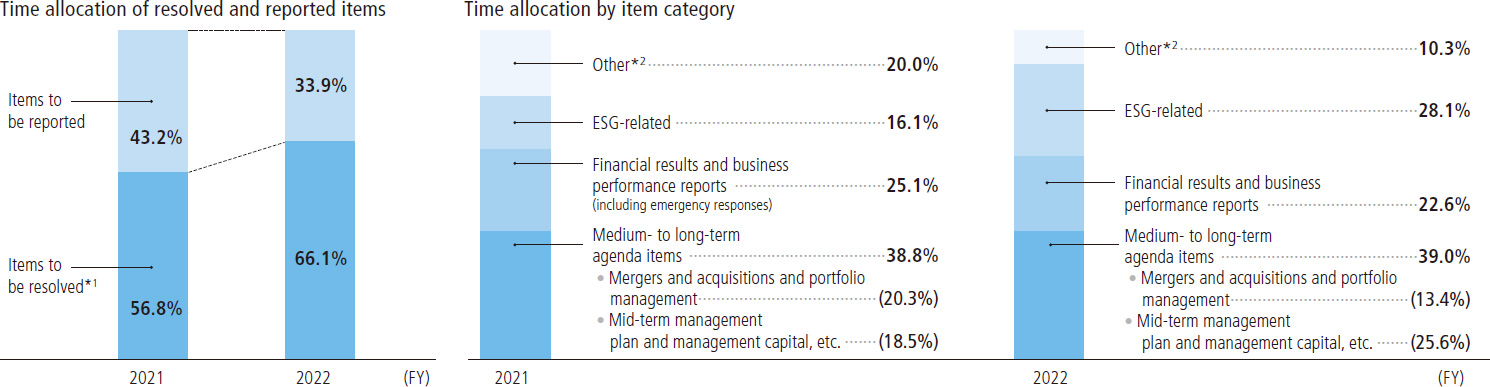

Summary of Board of Directors effectiveness assessment for fiscal 2022

This evaluation focused not just on the effectiveness of the Board of Directors but also on how executives responded to requests from the Nomination Committee, Compensation Committee, and Board of Directors. In addition, a third-party evaluation was implemented to ensure objectivity.

Fiscal 2022 Board of Directors effectiveness assessment

Evaluation process

The evaluation was conducted through discussions attended by all Directors and Audit and Supervisory Board Members, after sharing their written assessments and the analysis of third-party questionnaires to ensure anonymity. Through the discussions, participants reviewed and evaluated the Board's performance during fiscal 2022, in terms of the basic policies on the operation of the Board of Directors and the three improvement items, which were set forth by the Board in the previous effectiveness assessment.

- Monitor and support important measures to achieve the goals of the final year of the 20th MTP

- Discuss and support the formulation of the 21st MTS with the aim of maximizing corporate value as a digital services company

- In a highly uncertain business environment, monitor the progress of key management indicators and measures to achieve the business plan for fiscal 2022, and encourage execution as necessary

- In order to maximize corporate value as a digital services company, further enhance discussions on management structure, including business structure transformation, increasing corporate value and capital profitability, and human capital to support this, and reflect the results in the 21st MTS

- Along with continuous improvement of corporate governance, inspect and supervise the business unit structure, risk management system, new personnel system, ESG (future finances), etc., to create an environment for sustainable growth

Results summary of the evaluation of effectiveness of the Board of Directors for fiscal 2022

1. Results of operation of the Board of Directors

In fiscal 2022, the final year of the 20th MTP, we monitored the progress of key indicators and measures for each business unit, and also deliberated on medium- and long-term management policies and strategies based on the annual plan as the year for formulating the 21st MTS. With respect to the CEO Succession Plan, the Nomination Committee had sufficient meetings and time to conduct the final selection of the successor CEO and discuss the new management structure.

In addition to the on-site inspections by Outside Directors and Outside Audit and Supervisory Board Members, roundtable discussions with local employees, and participation in management meetings as observers to gain an understanding of the Company's actual situation, opportunities were provided for dialogue through small meetings between shareholders and Outside Directors to deepen discussions from the shareholders' perspective, with the aim of reflecting the shareholders' views in management.

In order to ensure transparency of deliberations at the Board of Directors meetings, the following disclosure regarding time allocated for the agenda items for the fiscal 2022 Board of Directors meetings is provided.

- *1

- Items to be resolved: In addition to agenda items for resolution by the Board of Directors, these include Directors' review meetings and governance review meetings held to prepare for deliberations

- *2

- Other: Resolutions in keeping of the provisions of the Companies Act, personnel matters, other individual proposals, and other factors

2. Summary

The following summarizes the results of Board of Directors deliberations regarding written evaluations from directors and members of the Audit and Supervisory Board and third-party evaluations.

The unanimous evaluation was that the composition of the Board of Directors was appropriate, that free and vigorous discussions were held under the Chairperson of the Board of Directors, an Outside Director, who presided from a neutral standpoint, that appropriate supervision and decision-making were carried out in response to various changes in the business environment, and that the effectiveness of the Board of Directors was ensured.

The Nomination Committee ensured that the process of the changes of CEO was highly fair and transparent, and the Compensation Committee revised the executive compensation system from a shareholder perspective, including the introduction of performance- linked stock-based compensation. Both committees, which are chaired by an Outside Director and consist of a majority of Outside Directors, conducted extensive deliberations and were evaluated as effectively functioning as advisory bodies to the Board of Directors.

It was judged that the selection of a new Lead Independent Director has further strengthened the effectiveness of governance, and the Board of Directors now engages in deliberations with a more shareholder-oriented perspective, with Directors aware of shareholder expectations and concerns through ongoing shareholder relations efforts by senior management and small meetings between shareholders and Outside Directors.

On the other hand, it was pointed out that further enhancement of deliberations and response to issues to achieve corporate value that meets the expectations of stakeholders and qualitative growth with transformation into a digital services company through steady implementation of the fiscal 2023 business plan are needed, based on the trends of the Company's corporate value and evaluation of the current business performance.

In addition, it was pointed out that, in transforming the business structure, it is necessary to review and continuously improve integrated risk management under the business unit structure.

Fiscal 2022 action items 1 and 2

In a highly uncertain business environment, the Board of Directors made efforts to understand the actual status of the business through monitoring the performance and measures of each business unit, and encouraged improvement of issues in response to the business environment.

It was positively evaluated that the Board of Directors also supported the development of the management infrastructure through deliberations on human capital strengthening, capital policy, and IT infrastructure overhaul, laying the foundation for the implementation strategies under the 21st MTS, as well as supervision and decision-making toward the transformation of the business structure, including implementation of growth investments and business alliances aimed at strengthening digital services.

On the other hand, recognizing that the highly uncertain business environment will continue, there were remarks pointing out the need for discussion on a resilient management structure, as well as the need to accelerate the transformation of the business structure to enhance corporate value, and the importance of deepening discussions on improving the profitability of the office services business and business portfolio management using ROIC.

Fiscal 2022 action item 3

The Board of Directors was commended for sharing governance issues through governance review meetings and Outside Executive Meetings, and for regularly requesting reports on internal audits, risk management, and ESG progress to strengthen the governance structure necessary for a digital services company.

Efforts to directly understand the operation status of the new personnel system and environmental initiatives through on-site inspections and communication with local employees, as well as in-depth discussions at Board of Directors' meetings and inspections from multiple perspectives, were highly evaluated as having led to improved effectiveness of the supervisory function.

Meanwhile, the need for verification of integrated risk management in accordance with the management structure based on the business unit structure, the response to risks specific to each region and business unit, the head office structure, and Ricoh-style job-based personnel system and its operation was also pointed out.

Efforts to improve the effectiveness of the Board of Directors in fiscal 2023

Based on the above evaluation, the Company's Board of Directors will operate in accordance with the following basic policies and work to improve the effectiveness of the Board of Directors based on three specific action items.

Basic policies for fiscal 2023

- Discuss and oversee the realization of corporate value that meets stakeholder expectations

- Monitor and support performance and key measures, from both quantitative and qualitative aspects, to achieve qualitative growth with transformation into a digital services company

Fiscal 2023 action items

- Enhance deliberations on improving corporate value, deepen discussions to a level where concrete measures can be implemented, and provide more effective supervision from the perspective of corporate value

- Supervise and support the Company to achieve qualitative growth with transformation into a digital services company through steady implementation of the fiscal 2023 business plan

- Continuously improve integrated risk management linked to the management system, which enables both sound risk-taking and risk control in order to accelerate the transformation into a digital services company

Approach to Election of Audit & Supervisory Board Members

Election Criteria for Audit & Supervisory Board Members

Candidates for Audit & Supervisory Board Member are selected for their appropriateness as personnel able to contribute, through the performance of duties as an Audit & Supervisory Board Member, to sound and sustained growth of the Company and the medium- to long-term enhancement of its corporate value, taking into consideration the balance of knowledge, experience and specialized abilities required of the Audit & Supervisory Board.

The following criteria (requirement definitions) have been established by the Audit & Supervisory Board in order to select candidates for Audit & Supervisory Board Member based on objective assessment of their suitability.

- Appropriate experience, ability, and the necessary knowledge regarding finance, accounting and law

- Professional skepticism and the ability to investigate facts properly, with an earnest attitude, and exercise objective judgement

- Sense of duty and courage founded on personal beliefs, and the ability to make active and forthright suggestions and proposals to Directors and employees

- The ability to see matters from a shareholders' perspective, act on this perspective, and engage in audits based on an attitude of learning from actual front lines, actual things and actual facts

- Healthy in mind and body, and able to serve for a full four-year tenure as Audit & Supervisory Board Member

- Always aspires to improve him/herself, with a desire to learn new things

- Able to manage local staff and communicate in English

Election Criteria for Outside Audit & Supervisory Board Members

In addition to the criteria above, Outside Audit & Supervisory Board Members are elected based on their high degree of specialist insight in the fields of corporate management, finance, accounting and law, and their extensive experience. The absence of any issues of independence regarding their relationships with the Company, its Representative Director, other Directors and important employees, with reference to the Company's Standards for Independence of Outside Directors and Outside Audit & Supervisory Board Members, is an additional criterion.

Diversity

When considering diversity in the appointment of Audit & Supervisory Board Members, no distinction is made on the basis of race, ethnicity, gender, nationality or similar attributes, and candidates are selected based on their character and knowledge, thus ensuring diversity in such attributes.

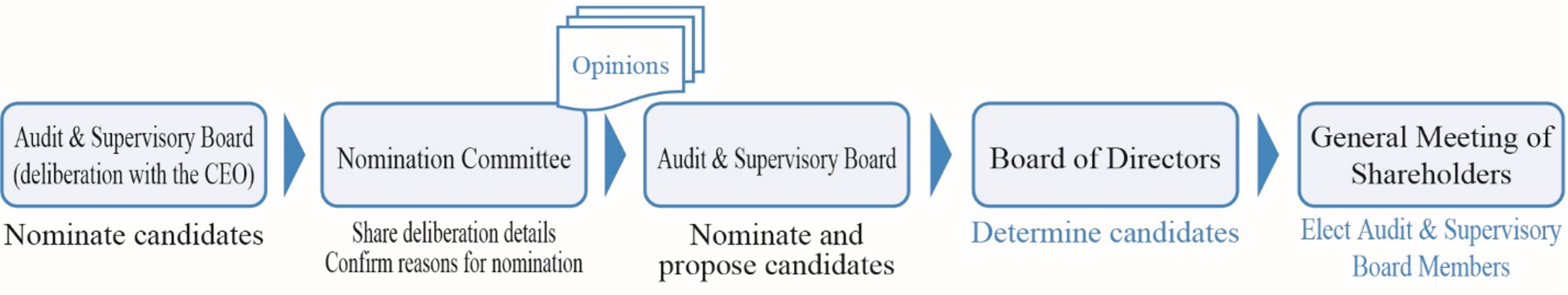

Election Process for Audit & Supervisory Board Members

“Recommendation of candidates” and “nomination of candidates” for Audit & Supervisory Board Member is conducted primarily by the Audit & Supervisory Board, in accordance with the process shown below, with an emphasis on ensuring the independence of Audit & Supervisory Board Members. The Audit & Supervisory Board recommends candidates based on the election criteria for Audit & Supervisory Board Members and after deliberation with the CEO. These candidates are nominated and proposed after confirmation by the Nomination Committee.

The Board of Directors respects the judgment of the Audit & Supervisory Board in resolving the nomination of candidates for Audit & Supervisory Board Member.

Training for Directors and Audit and Supervisory Board Members

Training for the Company's Directors and Audit & Supervisory Board Members has the objective of enabling constructive discussion that contributes to improving corporate value and shareholder value via the oversight functions of the Board of Directors. It is conducted by acquiring and updating knowledge specific to the duties and environment for each of the Company's Internal and Outside Directors and Audit & Supervisory Board Members. The goal of the training is to enable them to fulfill their roles and responsibilities fit for an executive that undertakes a position in the Company's important governing bodies.

Upon appointment of Internal Directors and Audit & Supervisory Board Members, training is provided to allow these persons to confirm their expected roles and duties, as well as acquire knowledge necessary to carry out duties, including knowledge regarding corporate governance, law, and finance. Even after appointment, training opportunities are provided via internal/external training and e-learning initiatives suited to each Director and Audit & Supervisory Board Member so they can update their knowledge.

Outside Directors and Audit & Supervisory Board Members are appointed from among those who have adequate insight and experience necessary to carry out duties. Upon appointment, to enable them to deepen their understanding of the Company's current status, they are briefed on topics such as business strategy, financial conditions, and organizational structure as well as make site visits to key locations as required. In addition, even after appointment, efforts are made to ensure and improve the management oversight function of the Board of Directors and the effectiveness of audits by Audit & Supervisory Board Members, through the regular provision and sharing of information on the status of the Company, the management environment, risks in business operations, etc., as well as the provision of an opportunity to grasp the actual situation of the company, such as participation as an observer in the management meeting (Group Management Committee) and site inspections.

To confirm that the above measures are being conducted appropriately, their results are reported to the Board of Directors.

Cross-Shareholding

Policy Regarding Cross-Shareholdings

From the viewpoint of streamlining and strengthening of business alliances and development of collaborative businesses, the Company shall be able to hold shares of the relating partners only when such holding of shares is deemed necessary and effective for the future development of Ricoh Group, while taking into consideration of the returns such as dividends.

Specifically, the Board of Directors will verify each issue whether the benefits and risks of the holding are worth the capital cost, and if the holding loses significance in the medium- to long-term, they will be reduced accordingly.

Exercise Criteria for Voting Rights to Cross-Shareholdings

The Company will exercise voting rights attached to cross-shareholdings upon examining each agenda whether it enhances the corporate value of the investee in the medium- to long-term, or whether it impairs shareholder value, and determining approval or disapproval.